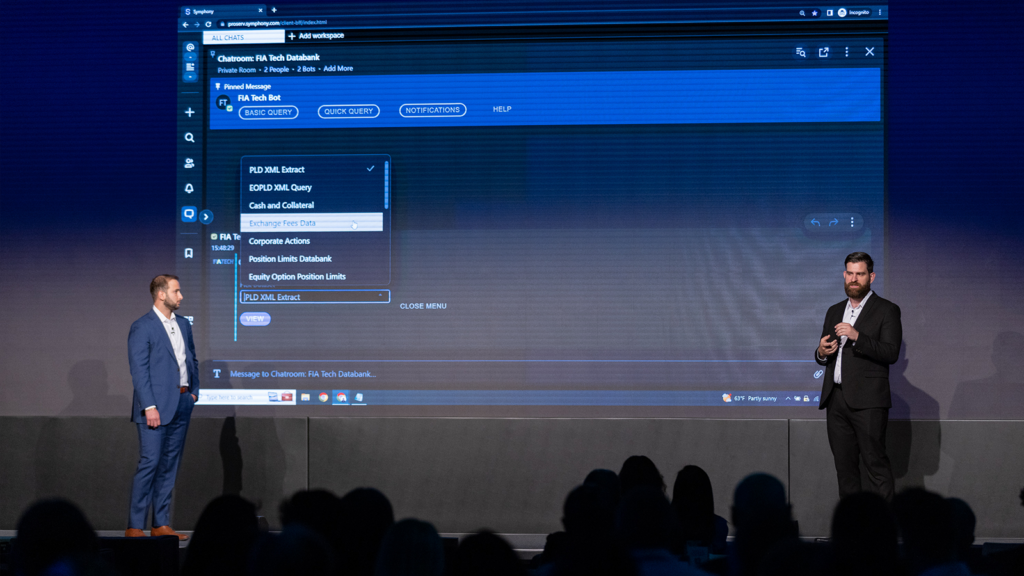

For Symphony, the beginning of the new decade arrives just as we’re crossing the halfway point of our company’s first ten years. A few months ago at our Innovate conference, our CEO David Gurlé spoke about the challenges facing global markets over the next five years. He touched on the complexity and fragmentation of financial markets, lack of standards, legacy infrastructure, shrinking margins, and the constant burden of regulations.

Our challenge for the next five years and beyond is to evolve the Symphony platform to support our customers as they navigate these issues. As we prepare to launch Symphony 2.0, we are not only monitoring the global finance vertical, but also developments in leading workplace collaboration platforms. Here’s a short preview of three trends we anticipate for 2020:

Collaboration across company lines

Businesses will require workplace collaboration platforms that function across organizations; the ability to chat and share workflows with internal colleagues is already the baseline. Workers need the same capabilities in their interactions with partners and customers. Email has this kind of universal reach but lacks security, extensibility and the efficiency of modern collaboration tools. Top SAAS providers are already demonstrating the value of providing APIs and automation capabilities that function between businesses. Box is a great example. Furthermore, B2B interactions will require standardized schema and data models.

Businesses with B2C interests will need to connect with consumer-centric platforms in order to reach the large pools of customers and prospects who are active in those communities. Our recent integration with WeChat is an example of how Symphony is evolving to address this demand.

Workplace collaboration tools customized by industry

Like other verticals, firms in Global Markets have industry-specific needs. Specialization will be critical for effective collaboration, especially in B2B markets. As we predicted last year, SAAS consolidation is happening. With fewer choices and less specialization in mass-market offerings, vertical markets will demand better fit to their specific needs. This creates opportunity for sector-specific solutions that generic platforms can’t offer.

Increased cloud adoption and accompanying security risks

As an increasing number of large enterprises opt into cloud-based technology solutions and tools, their security risks are shifting outside the boundaries of their proprietary systems. The compelling economics of the cloud makes this migration inevitable. This means handing a large part of the security practice to vendors who operate there. In 2020, businesses will be looking to partner with cloud-based collaboration platforms that offer more than procedural security – so we will hear more about end-to-end encryption, key management, confidential computing, and enclaves.

These are just a few of the trends we’ll be watching closely in the coming year. We have big plans for 2020, and we look forward to working with our customers and partners to bring them to life in the new decade.