Brad Levy, President, Chief Commercial Officer, Symphony: I’m really excited to be here with five active members of the Symphony community, participating in our Future of Markets panel today at Innovate 2020. It is a really great representation from across the industry and across the world, with expertise across the markets, each helping from their own personal seats. From the front office to the back and all areas of financial services, it’s a complex and fragmented and often bespoke and manual process. It is a resilient, but not very flexible or mobile system. Then the pandemic hits and exacerbates the challenges of this. But also shows us a glimpse of a more digital and distributed future.

So, we’re going to start with a discussion around front-to-back work flows, as this is becoming more clearly challenging in the environment we’re in and in the pace. Yannig, I’ll turn to you first. So COVID has created quite a bit of market uncertainty and volatility and stresses on the system and on the individuals in it, particularly in the trading environment. We saw some potential automations earlier with our SPARC initiative. Are you working differently today? Are there specific areas you’re focused on, to work in a more distributed and decentralized environment that we’re in today, Yannig?

Yannig Loyer, Global Head of Trading, Securities Financing and Derivatives, AXA IM: Yeah. Thank you Brad. So, clearly we entered uncharted territories with the COVID crisis. For us traders, we grew up thinking that trading had to be centralized on a trading floor and very suddenly, we had to completely change our set up, move to a decentralized, remote working environment, had to change the system and that in a very high trading volume environment, with actually unprecedented trading volume going through the pipes. Driven by market volatility of course and driven by the subscription and redemption on all fronts, as well as the market volatility, triggered some of that. Overall it worked and the market-infrastructure held well together, the markets kept functioning, liquidity grew up a little bit, but at the end, we were able to execute everything we wanted to execute. If I take a step back, what worked was actually, everything that was already straight through processed automated worked well, and every step where there was a little bit of a manual process or something actually took a bit more time, and that’s where the system stopped or started working less well, I would say.

In particular, we had a number of settlement failures increasing, the quality management was more difficult and so on. So what this crisis taught us is to automate everything possible, of course, build redundancy in the system, in market access, rethink our business continuity, obviously pushing, as you pointed out, for automating or making of front-to-back workflows as straight-through a process as possible. In particular, as far as trading is concerned, there are some areas where I think we can do a lot to improve the automation, primary markets being one area, derivatives being another, money-markets and financing clearly are some of the only types of automation and integrations as well and everything related to onboarding legal documentation and so on, can still be improved a lot. So these are the areas we are focusing on at the moment.

B. Levy: So it sounds like, what was front-to-back, worked well from a digital perspective, but what was prone to manual, broke pretty easily and it’s an opportunity to go after those areas now that are maybe more clearly shining in the light.

Sarah, largest asset-manager and also a major provider to many others in the market and have quite a large system operating in the front-to-back area. Many of your tools operate in the front office all the way to the back office. What are the trends that you are seeing in general in the digital transformation and how have you been evolving in your usage of, maybe a little bit prior, but even through how perceptions changed in the last six months?

Sarah Schaffer, Head of Aladdin Product Management, BlackRock: Sure, and more similar themes here obviously, but as we think about sort of pre-COVID and post-COVID, we were already seeing even sort of the fee pressures and the low-cost environment, as well as also, the market uncertainty. The way that portfolios were constructed was sort of changing. So as opposed to sort of active and passive, it’s both, as opposed to fixed-income and equity mandates, it’s both and now we’re also seeing sort of more and more going to the alternative strategies or private assets space.

So this multi-asset portfolio is the new portfolio of the future for us and also for our clients. But also, as we think about that broader whole portfolio, you also need one platform to have a look at your assets sort of across, to make sure that you’re delivering client outcomes and able to see everything in one place. So this concept of the end-to-end platform, is becoming truly table stakes, I think, for everybody. Frankly, that trend has continued to accelerate, post-COVID.

It’s also shined a light as you mentioned, on the end-to-end workflow. So you need to have sort of an electronic workflow, across the board, everything from your alpha generation process all the way down to settlement. There’s definitely spots in the value chain where we still have to work to do and I think those were definitely highlighted over the past couple of months. An area or two areas that we spent a lot of time on pre-COVID, that we’re quite thankful for, but continue to focus on is, you mentioned primary markets.

As we think about fixing the current ETF as an example, which I see tremendous growth in the markets over the past couple of years. We had put a lot of effort and energy into that primary market process. So create routine volume as it’s increased investing in the plumbing of that ecosystem, but also the plumbing of our own internal operations, to make sure that we could keep up with that volume and be sort of the best issuer, as well as also facilitate that work flow, as needed, downstream from an operational standpoint.

So there are certain markets that haven’t had the benefit of that electronification, where putting that investment up front, both for yourself, but also working with the ecosystem, was sort of so critical, going into COVID and we’ll keep doing that and that was sort of a great testament.

Then another area that I think has just more room to go and it’s obviously an adjacent market to the EFT market is, just fixing kind of more broadly your credit, as an example. So we still see for one particular bond or CUSIP, a portfolio manager and a trader spending an hour plus, going back and forth on assessing the market and available liquidity and pricing, price talk. So as we think about areas that definitely and that was a space that we saw go moving away from electronic actually, when the markets really became uncertain in the sort of March/April timeframe.

So an area that we know that we need to build up and shore up, some electronic capabilities, especially sort of in the larger sized tickets, is the fixing come electronic trading market. So we’re looking at different ways that we can sort of continue to evolve . That’s been a big focus for us, obviously, as a firm, but also for our client and in terms of providing the right connectivity and working with the right platforms. But I think it’s really actually the full value chain of providing and sort of making available good pricing, making sure we have the right analytics in place for that PM trader hand off, we do have that split in your particular shop and then also, making sure you’re aggregating liquidity in the right way, from a platform standpoint, or working with the right liquidity aggregators, to bring that available, so it can be timely for the trader, all the way through to execution tools. Do we have the right different, diverse channels and are we taking advantage of the right diverse protocols, whether it’s all-to-all trading, or otherwise.

So that was an area that we’ve done a lot of investment, but I think more to do, going forward and definitely hitting a pressure test, in COVID. So we’ll need to sort of continue to think of that digitization there.

B. Levy: Thanks so much. Yeah, interesting. The primary markets which don’t seem to get a lot of intention on the electronic or digital front, have definitely come into or more of a focus and maybe even correlated to the explosion in fixed-income issuance that’s been coincided there.

Brian, how’s it impacted your digital strategy, in terms of what you’re doing on automation in the front-to-back, maybe more middle-to-back even?

Brian Steele, Managing Director, Global Head of Market Solutions, Goldman Sachs: Yeah, thanks Brad. I think in many ways, COVID has reinforced the need for us to execute upon our sort of digital strategy in the firm. So that’s sort of establishing a seamless digital experience for our clients, that’s differentiated with innovative solutions, that work backwards from our own kind of clients’ unique needs. So that includes using cloud as an accelerant for innovative engineering solutions, that includes really looking outside first and building in-house later, which for us, leveraging third-party technologies, as a mechanism of change in the organization, as a real accelerant and a real compliment to where we should be making investments from an engineering perspective.

Equally, sort of delivering a cohesive client first sort of secure, scalable client experience, across all of our digital touchpoints. Frankly, importantly, meeting our clients where they are. Then probably last, is really around using developers as our most valuable or one of our most valuable clients. Really treating developers as kind of first-class citizens and offering programmatic access to all the functionality, via API, in addition to kind of human interfaces.

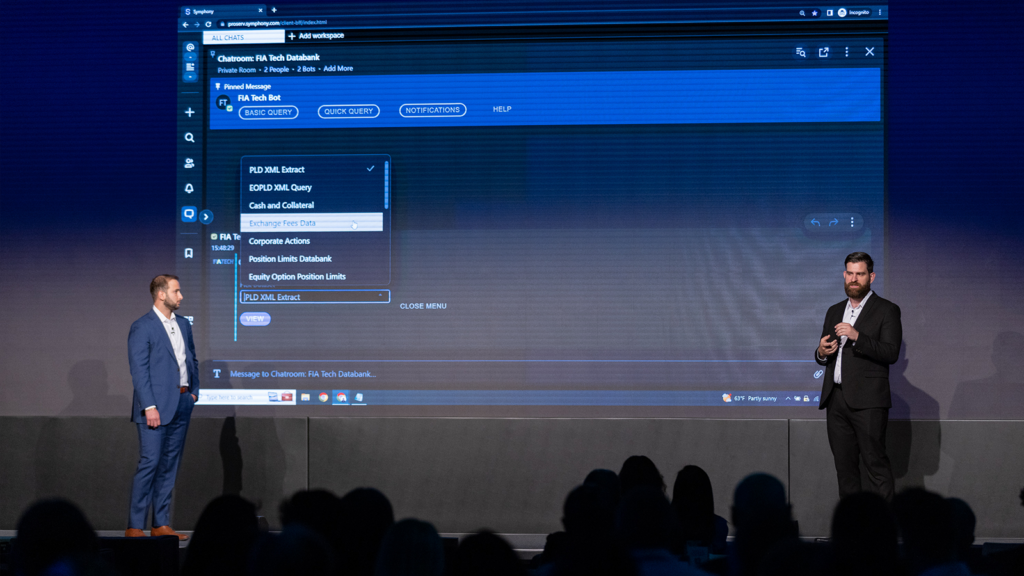

So really the latter two points are certainly where Symphony has helped play an important role in our journey, being API-led and using bots to enable workflow and allowing for a collaborative environment where we can meet our clients where they are.

B. Levy: Interesting. Fidelis, on the APAC side, having come into the pandemic, prior to the rest and maybe even come out. We’ll see what the cycles look like in terms of phases in the future. Anything, observations from APAC specifically, as you’ve heard some of the themes that have come about, come around already in the discussion?

Fidelis Oruche, Head of Investment Advisory and Sales, Bank of Singapore: Yeah, thanks very much. So maybe a couple of points. APAC, I think clients here have had pretty much the same sorts of problems that you’ve seen in the rest of the world. Coming from the private bank space, the particular problems we’ve had as an institution, are maybe a little bit different from some of those we’ve heard earlier.

I think one thing that we’ve seen is that the mindset that drew a dot to technology has just been tremendous. For us, we introduced Symphony relatively recently, compared to perhaps some other firms. We saw engagement really explode through March and April. I think some key reasons for that were, to get content out to RMs really, really quickly, suddenly became critical. The ability to get feedback, as well, from that content, 24/7.

I think in the past, we were much more discreet in how we communicated with our RMs and clients. One thing that we’ve seen really become the norm now, in the last few months, has been a significant increase in communication frequency and then a preference for small bite-sized updates that are delivered digitally.

I think the clients here are the same as clients anywhere else. But I think that people have discovered that they need to immerse themselves in technology and just become digitally aware, that much quicker. So I think in the past, we had a digital roadmap, that was perhaps several months, a couple of years away. That’s really become front and center.

I think Zoom’s a great example. I mean, a year ago, a lot of people hadn’t heard of Zoom. Now everybody’s heard of Zoom. Zoom isn’t a brand anymore, it’s actually a verb. So I think the key problems are very, very similar. For us, what it’s told us is that we have to be digital. We’ve really got to think differently about how we communicate. The style of communication and the frequency of communication are the key things that have really seen a big change for us and we see that really changing the landscape, going forward.

B. Levy: Interesting, yeah it seems clear that maybe the consumer space and even the high network retail, it may lead technology, as opposed to institutional leading and driving down. Brian, to your point on security, client first, but also, they want to interact and they need to interact in a very secure way. Just moving the conversation along a little bit and bringing Adam in. Security and encryption. Deutsche’s been a big supporter of what we’re doing and Autobahn is one of the longest running electronic trading platforms in the market, fixed-income roots, back in the day. How did you re-think accessibility to the system, in this moment, security. In the consumer space, it may be a little bit easier to change your interaction, as people demand it, where maybe in the institutional markets, there’s a bit more gating and challenges to rolling your system forward and again, in the environment that we’re in now.

Adam Wall, Head of Autobahn Group, Deutsche Bank: Yeah, that’s absolutely right. Obviously, COVID’s had a pretty dramatic impact on working practices, over the last six months. Interestingly actually, there hasn’t been a massive significant change in how we look at cybersecurity. Lots of people at Deutsche Bank were already taking advantage of the ability to work remotely and so we had pretty much all of the necessary security controls in place. Obviously, I don’t think anyone was really expecting the vast majority of the workforce to suddenly go remote at one time. But actually, it was a pretty successful transition at Deutsche Bank.

I would say along with any major event, COVID has its challenges and there’s always a potential for new types of threats. So we’re lucky enough to have our threat intelligence team, who they monitor both physical and cyber threats and they’re working in concert with the rest of the industry, just to make sure that we’re all geared up to address any threats that come through.

For Autobahn specifically, I would say the story’s actually similar. We already had lots of strong protocols in place. I guess this changing work habits has really just been an opportunity to step back and say, “Look, is everything still working? Is everything still appropriate?” IP blocking is something that for example, we already had in place, to restrict access to certain jurisdictions, high risk jurisdictions. We took the opportunity to beef up that control, for example and make sure that Autobahn’s only being accessed from the most appropriate places.

You mentioned consumer technology. I think we’re actually lucky nowadays that some of the security measures that we’re implementing now, are just much more familiar to people. I remember a few years ago when we first started to implement multi-factor authentication, there was definitely some pushback from the institutional community, “It’s a change of protocol, why are we having to go through these processes?” I think so many people are now entirely familiar with having a secure token on their phone, using either internet banking, or email and using two-factor authentication, that I think everyone just realized secure communications are actually beneficial for all parties.

B. Levy: No, that’s a great point. Arguably, the seamlessness of that experience has improved a lot, in the last five years, as you really can do that multi-factor easily, but securely. So this collision is benefiting us for sure in our world and we’d expect to see an ebb and flow between the two.

Yannig, on your side, from your perspective on trading communications, secure and proprietary, there’s these systems like Autobahn, which has been battle tested over years and has its act together. When you look at the wider communication space of trading and proprietary information, there’s a lot of different channels that people use to communicate. Has this impacted you in 2020, in terms of what you’re able to do, what you’d like to do, how you think about the level of information floating around and the security around it, beyond things that may have been more built for an environment that is a bit more distributed?

Y. Loyer: Yes, of course we had to adapt as we moved to a decentralized, or more precisely, a semi-centralized operations. So we had to adapt the way we communicate. When internally within the desk, where we communicate with clients, where we communicate with brokers and interestingly, we’ve gotten feedback that there was more communication, during the COVID crisis than there was prior to the crisis, from the, according to clients. We did something right. In terms of tools, yes, I mean we discussed Zoom before. We were lucky enough to onboard Symphony, actually I must say a few weeks before the COVID, so of course with usage, it worked very quickly for the trading desk during that crisis and that was a common tool to use.

In terms of trading systems, a point I would like to make is, the first parameter about information being, all of the security of information, is a number of people who can look at this information and we’ve been long time promoters of bilateral connectivity, between buy side and sell side. We are very happy to see that actually today and this theme is finally emerging as one of the themes to define the market structure going forward.

I think we’ve been using bilateral connectivity for more than 10 years now, for AXEs distribution solution in particular, where no one needs to see apart from the bank’s actuary and notary and us, looking at AXEs, no one else needs to see what information is transferred and that’s been a very efficient way to communicate securely. So when we think about that, there is much more information we can push and in particular in the decentralized or semi-centralized within relation, we should be able to use this bilateral communication to stream AXEs, to stream prices, to stream IOIs, to stream value, trades, trade formation, anything that doesn’t need a multilateral platform. The information is much more secure when channels connect bilaterally from one to the other. So we are very happy in promoting this bilateral connectivity between the firms and happy to see that accelerate now.

B. Levy: Very interesting. The idea of introducing other parties into your transaction on any level, would introduce some risk potentially, so more direct connectivity in theory, could lower that risk of proprietary information getting out, by either accident or maybe even bad actors.

Brian, when we think about the process after the trade in the middle and back office, which oftentimes, many parties need to get involved and even individuals who don’t understand even the sensitivity of the information, at times. How have you seen that environment change a bit, where it almost by definition is a more multilateral environment, just because the nature of settling trades, custody in trades, servicing trade more generally? Have you seen changes in the middle and back office, as it relates to the views around security and methods?

B. Steele: Sure, I mean I think, Brad, I think for the middle and back office, there have really been changes in communication. I think COVID in a lot of ways, has been a bit of a catalyst for change and not only kind of change within your own firm, but certainly change that’s dependent on forces that exist outside the firm. So regulators and market structure, others that sort of are holding to a particular convention.

I think what we saw and maybe building on what Fidelis said earlier, in terms of what we’ve seen since COVID, is really a need for real-time communication, in collaboration, with our clients and other industry constituents and that was I think, most pronounced as we went through significant periods of market volatility and volumes, in kind of the March and April time period, earlier this year.

So I think what we had seen since COVID started is, a significant uptake in usage of Symphony, as one of those methods of really kind of collaborating and communicating with our clients, to the tune of some instrument of the firm around 550%, we’ve increased the number of messages across the firm. Which I think is sort of a staggering number, if you think, to some degree it’s somewhat sad that it took a pandemic to sort of increase usage to this degree. But it’s really been a catalyst for us now to become commonplace, for us to use Symphony in this way.

I think one of the events that occurred in that kind of period of market volatility, was really how do we best communicate with our clients and collaborate? There was a weekend event at one point in time, where we were trying to manage down, sort of some of the operational friction that exists, sort of at the end of the process around settlements. We really used Symphony as the vehicle to do that, to both collaborate internally, across different constituents, in sort of the front office, the middle office and the back office, as well as externally. We were sort of in real-time communication with our external constituents. We were able to incredibly efficiently address a lot of the challenges that we saw, that really helped us get through that period of volatility.

Then I think the other piece of it and I touched a little bit on it earlier is, the pandemic has been a catalyst for change. So where things like e-signatures weren’t sort of a normal course of business on issuance documentation. Well they were forced to be, right? In cases where you couldn’t pick up a physical document and run it down to the place where it needed to get to, or the market structure that needed it in hand, or the dematerialization of assets. The digital negotiation between un-documents and agreements. There’s so many, what was certainly technology that existed before, but the pandemic has kind of forced the agenda to be much more commonplace and for us to institute those as part of our kind of digital transformation journey as an industry.

B. Levy: Yeah, no and email is clearly, when you think about real-time and somewhat insecure, email is an active tool, used in the middle to back office and it does seem like people have figured out that maybe that needs to change.

Fidelis, from your perspective, when you look at the maybe down into the wealth areas and security and email usage and how you’ve seen maybe an increase in communication in a real-time nature and a more bite-sized version of that. Have you seen email still as a dominant? Has there been changes to how you’re working? Is it starting to drift away from that, or is it just more communication in any form that the consumer would want?

F. Oruche: Look, I think the phrase, “Catalyst for change”, has been extremely true for us, as well. I think a really big change, look, as you said, a lot of meetings in the private wealth space historically, have been either conducted face-to-face, or via email, or by phone call. Something we saw a surge in, April, May, June and increasingly, just going forward. We’ve been using video, been using webinars. There are a couple reasons for this. I mean one is just the sheer scalability, the ability to reach out to a lot of people, at the same time. You can control the narrative much better, the visuals, the way in which you deliver the content.

But then I think the other thing that we’ve also been able to do, quite effectively, is really capture a lot of data. So in terms of what’s the sign up, how many people do you have there? What bits of content were most favored? How can you track follow up from that afterwards? So you capture a lot of data and we’ve been able to get a lot of feedback, coming back from that, which then allows us to tailor the next ribbon of that a bit better. Tailor the sort of content that we want to get out to different sorts of client groups.

I think the style of communication as well, I made a bit of reference to this earlier. But I think increased frequency of communication. Perhaps smaller bites of communication, in making sure that they go digitally, are things that we found have been very well received and are really improving the effectiveness, if you like, of what we do.

Then perhaps the last thing that is really something we’ve always been moving towards, but it’s really been accelerated, is really going directly to clients. So the wealth business, certainly in this part of the world, has historically been an RM-driven model. So you’ve got the RMs to clients. I think all of a sudden, we realized that that just doesn’t work, when you can’t have face-to-face interaction. So it’s really made people think twice about, “Well, how do we go straight to clients? How do we do it effectively? How do we gather feedback and how do we constantly reinforce that feedback loop, to make sure that we’re really getting mindshare of clients more effectively?” So yeah, that’d probably be the key things that I’d point to.

B. Levy: Thanks, Fidelis. Then an emerging of what goes on in an institutional or a consumer space, Adam, Deutsche Bank, one of our early adopters of our WeChat and WhatsApp Connect product where we’re able to bridge those communities securely and from a bank perspective. Can you talk about why that’s been important for Deutsche, as an initiative, in the last months?

A. Wall: Yeah, absolutely. I would echo the comments of Yannig and Brian, on the importance of communication. What we really want to be able to do is, provide secure communication, along the channels that our clients want to use. Obviously, messaging apps such as WhatsApp, WeChat, are some of the most prominent and convenient tools. Historically however, they have not been, if it’s staying within the WhatsApp ecosystem, it’s not up to our compliance requirements and we need to be able to communicate in a fully compliant way.

So in order to get rid of that lack of transparency and make it fully compliant, we worked with Symphony, we integrated WeChat backend of last year and then WhatsApp towards the middle of this year. It means that those clients that are using those messaging applications, can send messages, which then get passed directly into Deutsche Bank’s secure Symphony environment and then straight into our own compliance framework. Because Symphony’s already a tool that we’re using extensively internally, very little additional effort is required in order to get those messages into our compliance systems and in that way, we ensure a fully compliant audit trail.

It was actually a really successful project for us, because it’s something which was client demand, so there was a clear aim for the project. It was something that was entirely supported by the front office, because they could see it as an obvious way to improve their lives. Plus, it was championed by compliance internally, because the solution was so neat and plugged straight into our existing systems and then finally, the implementation with Symphony was very smooth.

A. Wall: So I think that’s really critical for us to find ways that are that combination of client demand, but also that we can manage to implement securely and you’ll know Brad, that we’re looking at similar ways to leverage things like the customer connect product and the community connect products, to do exactly that sort of thing, with communication to ensure secure communications with clients, through Autobahn.

B. Levy: Thank you, that’s great. I have a job for you in sales. You’re wonderful. As we think of five years ago, the industry was really, I would say, anti-cloud almost, certainly not big and supportive of it and three years ago, you would not have expected an environment where WeChat and WhatsApp were becoming part of our system, versus something that you had to tell people not to use. So really amazing how things have changed, in only the last couple of years. Just turning to our last theme that we’ll pick up on here, it’s really taking a little bit more of a look out and maybe the things that we’ll see today and deny or get wrong soon. As an industry, we do seem to want less in our lives that drives change as a catalyst, but here we are.

Sarah, BlackRock a very early supporter of Symphony, in their day one and in general, moving along on a lot of fronts. What other fintech trends do you see, a little bit longer ranging, maybe out as far as 2030, but maybe the next five to 10 years where, these are technologies that are emerging, maybe they’re not quite there, or have been there and have not been utilized as much. What do you think is a little bit beyond the API or the multi-factor, or the cloud even?

S. Schaffer: Yeah and there is a popular quote that oftentimes, we overestimate what we can get done in two years and underestimate the 10 year horizon. So hopefully, I try and get it somewhere in the middle here. But I think there’s probably three things that we’re going to see, sort of uniquely in our industry, 10 years from now. It’s building upon what we’ve talked about today.

I think the first is, this concept of building virtual community and this is obviously something that we’ve spent a lot of time with you guys on, as it relates to Symphony. But building virtual communities and network effects around community, is going to be a very big trend that’s going to continue to accelerate, especially in a post-COVID world and how we sort of do that and facilitate that, is going to be sort of the first thing.

The second is probably just this concept of consumerization. So we think about our own personal banking experiences and what it sort of looks like for us, literally on our phones. The sort of fintech landscape has quite a bit of a ways to catch up, in terms of that sort of seamless experience, the modern look and feel, the learnability. So to think about sort of just how without training, you can sort of easily download an app and get going. We’re far from that today, but obviously a big focus area for us and I’m sure many folks around this virtual round table and that consumerization is beyond just sort of the way these screens look, but also, in terms of again, how we use them.

I think the third is: open platform. So we’ve been talking a lot about APIs and cloud and I think this sort of product versus platform, we’re sort of moving into a platform world, we’re all going to be there 10 years from now. It’s interesting, we did a survey internally at BlackRock and I believe the number was 30% of employees, self-identified as technologists and so when you think about what that’s going to look like, five to 10 years from now, everyone needs to have an open platform and I believe Brian sort of shared this earlier, so just to build on that point, no one has the best ideas, just themselves. No one’s really thinking about the build it all themselves any longer.

It’s about sort of federating the model, putting it out to citizen developers and having them build, obviously in a safe and secure way, on top of open platforms. We’ll see that continue to accelerate to a point where, I wouldn’t be surprised if in a couple of years our in-house class, is sort of trending to 100% self-identify as technologists and what are the tools we need to provide to them, to help them be successful in-seat and innovate on the job, in sort of their day-to-day, because I can’t come up with that idea, but they certainly can, if they’re sitting there. So it’s sort of about sort of freeing and federating the model and thinking differently.

So like everything to your point, is going to be API. Everything’s going to be sort of a sandbox and a toolkit and as we think about how that applies to financial services, especially in areas like sort of idea generation, alpha generation, a lot more we could do to harness data in the research process upstream. So we think about sort of the end-to-end electronification that’s often in that workflow, that middle and the core. I think on the edges, we sort of have idea generation and sort of thinking about alpha and then on the other side, it’s sort of how do you reach your clients and that’s the consumerization. Those two pillars as anchors, I think we’re going to see a lot of innovation over the next couple of years and we still haven’t, I think, collectively as an industry, harnessed all of the data.

We think about sort of two big areas I referenced earlier. One is sustainability. I think that’s an area where we’re still sort of haven’t gotten through the full benefit of a transparent data system. Then I think the second is, again, private markets. I think there is definitely a data frontier there, that we’ll see sort of as we did in the public markets, maybe over decades ago. So two kind of key areas, specifically in the data space that we still need to harness and get a lot of benefit out of. We’ll see a lot of both companies and platforms, sort of emerge, I’m sure, to help solve some of those challenges for investors.

But I think those are the three big themes, which is sort of virtual communities, open platform and sort of harnessing data and the consumerization and modernization that we need to have from an institutional perspective, to your point, Brad. Really catch up with both, the wealth sector, but even just again, the consumer sector and sort of what we have all in our pockets, in terms of what we can access from a digital standpoint, day-to-day.

B. Levy: Brian, what do you see as the large themes from your perspective, looking out a bit further?

B. Steele: Yeah, I mean I think just Sarah made some really good points, I think just building on, I think cliché would be the real changes in the future are going to be through sort of the ABCDs of technology. AI, block chain and cloud and data. But I think, just maybe two points I’d say, in terms of themes that we’ll continue to see beyond the ABCDs, is really the use of low code as sort of a mechanism of change and open source, right? So Sarah touched on open platforms, I think open source is one more generally.

On the low code side, it’s really leveraging, as Sarah said, citizens, developers and engineers, right? It’s leveraging the power of a broader community, to affect change, but still in a very controlled manner than that would exist with your traditional technologists. I think from an open source point-of-view, I think firms will continue to realize that there’s a broader, collective value that is achieved through open source, then there is through the differentiating value of retaining those technology assets, within each of our respective firms.

I think an example of this for us, is we’re open sourcing a platform called Alloy, which is a data modeling framework. Brad, you’ll be familiar of open sourcing with FINOS of course, as the foundation to do so. I think frankly, that builds upon a broader theme that we’ll continue to see in the industry, which is to achieve sort of end-to-end digital transformation. You need common standards, right? Common industry standards, common data model standards, common reference data standards. So we’ll continue to see that. I know Brad, one of the things that kind of our two organizations are working together on, with many others is, really the establishment of a digital identity. The concept of a digital identity and that being a pretty powerful proposition, as an industry, to better understand the roles, the functional coverage, the organizational hierarchy that exists across individuals in the industry, which today is sort of either managed in databases that are retained within our own firms, or its sort of tribal knowledge that an individual knows who does what across the street.

So that could be a pretty powerful proposition as a repository of data that we can build upon and that not only facilitating kind of more efficient human-to-human contact, but as I think about where technologies enabling, it’s machine-to-machine connectivity, that source of reference data like digital identity, will become increasingly more important in the future.

B. Levy: Thanks so much, Brian. Many trigger words there for me. Thank you, I appreciated it. Adam, we’ve heard a number of times, people referencing being more open, realizing they can’t do everything themselves, listening to the bottom, as driving the future a bit more. When you think of partners for yourself, going forward, how do you think about the ideas of partnerships, across the board, from large technologies, to other data, to whatever you think you need to succeed? It sounds like nobody can do it all alone.

A. Wall: I think that’s absolutely right and it’s exciting times for Deutsche Bank. It’s good timing on the question, because seeing that a few weeks ago we just announced a major new partnership with Google. So we’ve had a cloud first approach for awhile now, as part of our strategy and cementing this broader partnership now with Google is really going to be the key that ramps up our modernization of our technology infrastructure and something which is absolutely critical to the broader data strategy of course.

There are definitely cost savings associated with a flexible consumption model. But it’s much broader than that. I think we, from a Autobahn standpoint, we’re definitely looking at the benefit from being able to improve the speed of application development, deploy platform improvements much more rapidly and just generally, become more agile as a firm.

Your question was about partnership and it is much more than just finding a cloud provider. We’re really thinking about this as a partnership with Google. There’s been a lot of work at Deutsche Bank, over the last few years, to create that kind of engineering culture and break down the mentality of front office versus technology. It’s an emerging, we’re getting there. I would say that probably no more than 30% of our senior management would self-identify as technologists. But, I do think there’s a realization nowadays, that you can’t have business strategy, without having an accompanying digital strategy. People at least, have got that far and I think our work with Google over the next few years, is going to keep us moving down that cultural journey and our engineers are very excited they’re going to get work alongside a lot of really smart technologists. It’s going to be a great learning opportunity, I think actually, on both sides. I would hope that we might teach Google one or two things about banking, who knows? But it’s definitely we’ll continue to attract and retain the best hand in the market.

B. Levy: With everybody becoming a technologist, it’s hard to imagine who you’d argue with, other than yourself in the future, so. Sarah, I know you’re doing a lot to enable self-serve and areas where you yourself and your partners, or other providers, can engage on Aladdin and what you’re doing there, if you could speak to that a bit, API-led.

S. Schaffer: Sure thing. Yeah, just building on the same themes around open platform. We definitely had a bit of a cultural change internally at BlackRock and with Aladdin, which is our platform that we offer externally and also leverage internally around sort of building everything ourselves, versus moving toward more of a partner ecosystem, to extend our reach. So we’re spending a lot of time, as I mentioned earlier, with industry utilities. Obviously, we were an early adopter of Symphony, through the collaboration and community perspective.

I’ve seen quite an uptick of post-COVID, as well, to draw on an earlier point, but we don’t need to build everything ourselves. I think our goal is to sort of look across the ecosystem and think about where we can find the right partners to solve the problems in front of us. So as we think about sort of developing more of a partner ecosystem and a partner program, as a platform, that’s going to mean that we’re going to hopefully find partners where we win together and we’re both looking to solve the same problem and it makes sense to sort of do it in more of an industry way, as opposed to sort of doing it just for us.

So, spending a lot of time thinking through that and that’s really across the value chain, everything from data providers, through to sort of operations and post-trade settlement capabilities, where we’re looking to sort of create those virtual and sort of electronic communities across the board.

Today, it’s really about connectivity and interoperability with those partners and sort of building something together, maybe finding a packet of new market structure. But ultimately, we do see an environment down the road, where those partners could be building on our platform, as well. So sort of taking that further, as we think about being an open API ecosystem, such that our partners can be offering their capabilities directly on the platform and through servicing our clients in that capacity. So obviously, not there yet, today. But that’s sort of the vision for the longer term, as we think about Aladdin.

B. Levy: We look forward to that ourselves. Yannig, I’ll give you the last say. Technologies from the past or the future, will the mainframe and the fax machine coming back? There are actually people that have taken faxes on over email, as a more secure protocol, interestingly. Not sure that’s the right answer, but, what do you think? What does the future look like a bit, from a technical perspective?

Y. Loyer: We need to realize that trading is quite advanced already, in terms of technology. So, let’s not throw out the baby with the bathwater. Yeah, we need to leverage on that to develop the future of infrastructure. Echoing what has been said already, but I think two themes that will really define the future of trading systems are interoperability and economy. Interoperability I think is becoming more crucial than before, as a trading system-abled market, as the market starts to evolve, as data becomes more important and the data science associated with it.

Systems are getting more specialized. Microservices are the start outs now. We need to combine what we buy and what we build, so we all have to integrate all this, without spending months in integrating the systems and I think as Brian said before, definitely the start up definition and the capacity to integrate quickly with all the technologists in the firm develop day-to-day is key. And the second part, which I think Sarah touched on as well, is economy. We have a very big difference today between what we have seen already in real life on iPhones and what we see in the trading softwares that are being developed. So we need to make this converge and make the systems as integrated into the trader’s life as possible, into the trading workflow, as integrated into how we live hour-by-hour.

So kind of get rid of very complex systems, difficult to parameter and have a smooth integration between the two are the two key themes that I see defining our future.

B. Levy: Excellent, thank you so much, Yannig. I’ll just offer a brief, I believe, AR and VR are critical areas of technology, as we try to blend man, woman and machine. But also, maybe just the combinations of technologies that will converge, versus any one technology and I would say the edge compute world, with bilateral market structures, is a really interesting combination to me, where you can be safely on your home base and communicating with your key relationships.

So I just wanted to thank you all, really wonderful discussion. Really thought provoking for myself and wide ranging, which is key. Because it is a wide world and lots of range. We appreciate you leading, not only for your firms, but in the industry and the Symphony community, as well and being part of Innovate this year. Thanks all, for taking time to watch this session. We’re looking forward to working with you all, on creating a more modern and more digital and more secure market for the future.