Disruptions, Disruptors…and the Disrupted

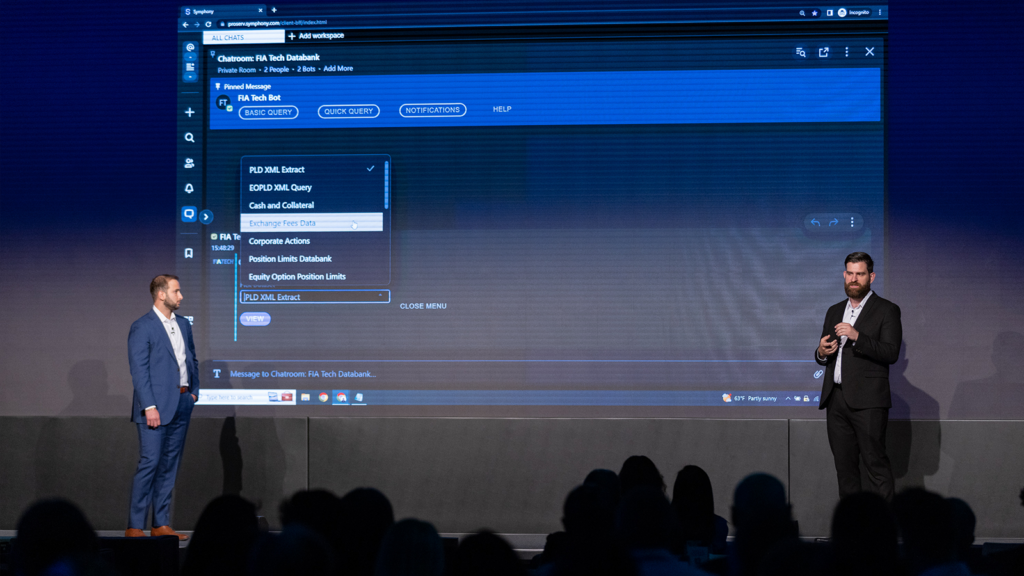

The 2020s are an unprecedented decade of disruption and every market participant is either the disruptor…or the disrupted. Today, we stand at the precipice of artificial general intelligence and every well-run organization should be actively seeking to disrupt themselves right now. Symphony has been able to remain almost a decade ahead of disruption by understanding one simple truth—thriving through disruption. This demands three things from your technology: resiliency, stability and flexibility.