Seamlessly moving to a T+1 settlement is only possible with a quantum leap in operational efficiency. Staff need to be able to retrieve the exact data they need in real-time to respond directly to clients and colleagues without leaving their workflow.

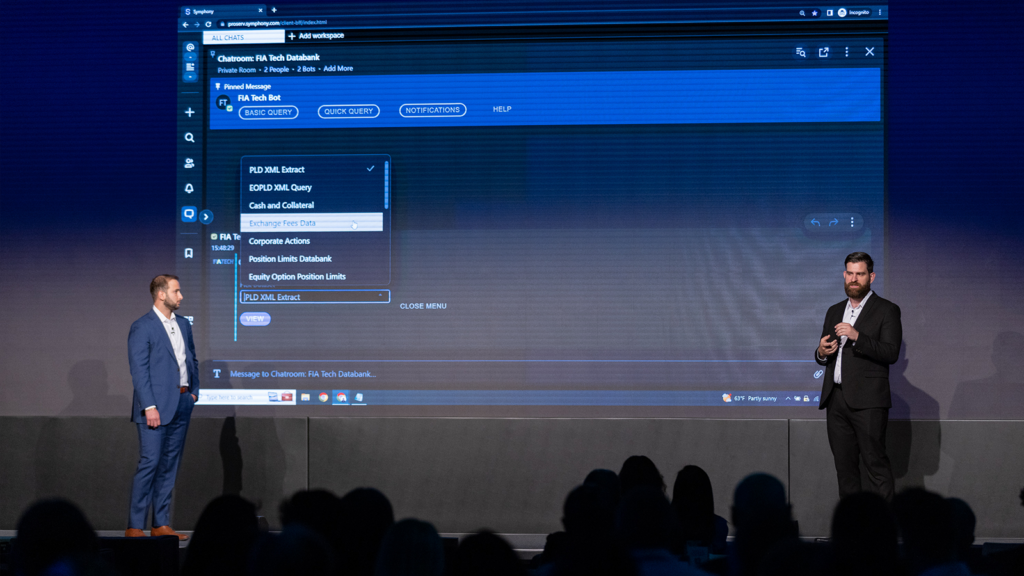

That’s why I was proud to work on one such solution – the TaDa bot – which was developed by ETD (formerly Euromoney TRADEDATA) for use on Symphony. TaDa enables users on-demand, automated access to ETD’s trusted reference data that can be added instantly to any Symphony chatroom.

“Firms want to cut down on the time and money wasted on processing problems such as post-trade risk, clearing, settlement and regulatory reporting issues. This begins with relieving teams from having to manually retrieve and reconcile siloed and fragmented data to report updates to clients and colleagues.” says Wendy Askew, Channel Development Manager, ETD.

By freeing valued professionals from what is essentially manual labor, TaDa bot empowers them to focus on performing value-added work that contributes to the bottom line. TaDa bot also:

Accelerate and safeguard processes: By removing the need to collate data across disparate systems within an institution, TaDa bot delivers substantial time saving while sharply reducing the risk of costly human errors. It also enhances overall efficiency while improving the resolution of post-trade risk, clearing, settlement and regulatory reporting issues.

This is particularly critical as operations teams are the backbone of financial institutions. Real-time data access through systems interoperability is key to their workflow efficiency, remediation cost reduction and pivotal to Regulatory compliance.

Instant access to market-leading reference data: TaDa bot users get instant access to the highest quality futures and options reference data across more than 110 global derivatives exchanges as well as to data sets on Corporate Actions, Symbology, Calendar Dates and historical Transaction Reporting.

Easy and cost effective integration with Symphony: Deployed on Symphony when added by a user, TaDa lets users access and share data seamlessly in real-time without having to leave your workflow. In addition, the set-up is immediate, implementation instantaneous and running costs minimal.

Whether T+1 gets implemented now or in 5 years, the pressure it will put on shortening cycles will dominate beyond the US – improving efficiency is an existential challenge for financial firms globally. As regulatory pressure increases and economic uncertainty remains constant, firms need to leverage the full potential of technology to cut costs, transform operations and meet the demands of regulators and customers.