Trusted connectivity for global finance

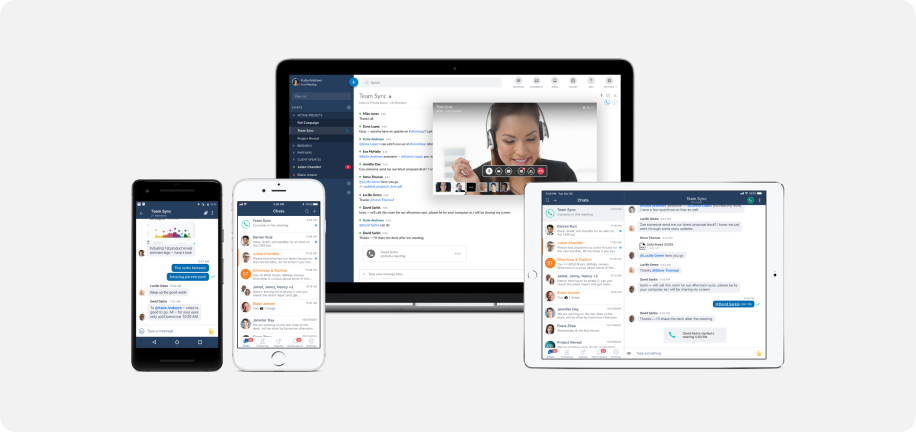

Symphony is a communication and markets technology company powered by interconnected platforms: messaging, voice, directory and analytics.

Our modular technology - built for global finance - enables over 1,300 institutions to achieve data security, navigate complex regulatory compliance and optimize business interactions.

Our story

From our founding in 2014 to our industry-leading position today, Symphony has consistently innovated to meet the evolving needs of financial services firms. We have expanded our offerings through strategic acquisitions and organic growth, establishing ourselves as a trusted partner for secure communication, collaboration, and data-driven insights.

Life at Symphony

Symphony’s company and culture are a lot like our platforms. They’re interconnected; they grow and thrive together for the greater good of our employees, customers, partners and the broader financial community.

Job opportunities at Symphony

Would you like to work at Symphony? Explore open job positions and apply to join the Symphony team!

Our values

Passion

We foster and share deep market and technical proficiencies. We are intensely curious and creative with collaboration and workflows.

Expertise

Our mission is to enable secure collaboration across global markets. We work through obstacles, adapt to change, and are driven in pursuit of our purpose.

Community

We are a diverse, equitable and inclusive organization that succeeds together. We enable communities. Symphony is how we connect, collaborate, and run our business

Trust

We strive for trust. We are transparent, meet our commitments, and do what we say. Our behavior and tone are trustworthy.

Ownership

We are empowered and accountable to put our employees and customers first. We are self-critical, learn from our mistakes, and celebrate our successes.

Security

Security is our key differentiator. The relentless pursuit of security guides all of our actions.

Our team

Our global leadership team brings together decades of deep financial markets management experience. They are committed to accelerating our trusted network across the industry and delivering the value of Symphony’s unique position as genuinely disruptive market infrastructure.

Our offices

New York

1245 Broadway, 3rd Floor

New York, NY 10001

Get Directions

London

135 Bishopsgate, 12th floor

London, EC2M 3TP

Get Directions

Singapore

50 Raffles Place, L30

Singapore Land Tower

Singapore 048623

Get Directions

Abu Dhabi

Cloud Spaces ADGM

Island – Level 15, Al Sarab Tower

ADGM – جزيرة المارية – أبو ظبي

Get Directions

Belfast

Clockwise Belfast

River House

40-60 High Street

Belfast BT1 2BE

Get Directions

Hong Kong

2F, 8 Queen’s Road East

Wanchai, Hong Kong

Get Directions

Paris

29-31 rue de Courcelles

75008 Paris

Get Directions

Pennington

12 W Delaware Avenue

Pennington, NJ 08534

Get Directions

Sophia Antipolis

Le Fairway – Bâtiment A

980 Avenue Roumanille

06410 Biot

Get Directions

Stockholm

Vasagatan 28

111 20 Stockholm

Get Directions

Tokyo

3F, Otemachi Financial City

Grand Cube

1-9-2 Otemachi

Chiyoda-ku, Tokyo, 100-0004

Get Directions

Sustainability at Symphony

Symphony is a privately-owned firm, with an office-based operation in a non-carbon intensive industry. The firm’s leadership is committed to the highest standards of responsible business practices and taking action towards a more sustainable future.

Get started with Symphony

We're happy to answer questions and get you acquainted with Symphony and our Messaging, Voice, Directory and Analytics platforms.

- Streamline secure collaboration

- Connect market participants and workflows

- Empower data and insights

- Enable security & compliance

- Deploy and build integrations, apps & bots

To view this form, please enable cookies in your browser settings. Click the cookie icon in the bottom right corner of your screen, select accept cookies, and refresh the page.