- Financial institutions should embrace the collaboration economy.

- A new era of innovation and prosperity is potentially on the horizon.

- Speed, agility and flexibility will become the new business currency.

- It’s time to rethink digital transformation playbooks.

As people around the world confront an ever-shifting new reality, it is becoming clear that the COVID-19 pandemic and economic aftermath will change the global business landscape for a sustained period of time, if not forever. According to one report, an analysis by the McKinsey Global Institute, the pandemic could potentially even cause a decline in economic activity in the U.S. and Europe that will far exceed the loss of income experienced during the Great Depression – in one single quarter. Yet, I see communities, industries and countries coming together in amazing ways. I remain optimistic that people are creative, innovative and resilient and that we will come out of this crisis even stronger.

Despite all the goodwill and policies, recovery will not happen overnight. When companies and the economy emerge from crisis mode (they will!), we must recognize that there is no going back to “business as usual.” For financial institutions, now is the time to ramp up investment in digital transformation. I talk to our customers every day and I know many rushed to remove blockers and to approve and onboard new solutions to maintain continuity. While they must keep an eye on security (we have just seen the situation with Zoom) and compliance, I am urging our customers to review their IT processes and re-align them for speed and flexibility so that we don’t lose the innovation wave that is now sweeping all the impossible things we couldn’t do in the past.

We are in the era of the collaboration economy which should be embraced by the whole financial services industry. This approach yields incredible potential: propels the industry forward and foster a new era of innovation and prosperity.

In the years immediately preceding the pandemic, banks were already under tremendous pressure to reduce costs, consolidate operations, navigate evolving regulatory mandates and evolve their technology infrastructure. COVID-19 has accelerated the imperative to embrace digital transformation in unprecedented ways. 9/11 reinforced the concept of disaster recovery, and the 2008 financial crisis introduced subsequent new regulations, of course. This current crisis will inevitably bring an even bigger sea of change to the financial sector, and with it enormous potential.

For instance, due to COVID-19, businesses are finding innovative ways to operate and collaborate outside the four walls of their traditional offices. Million-dollar deals are being transacted online. Traders are learning to work in distributed environments. Employees that nearly always checked into an office have found productive rhythms working remotely.

While many ask “what is the new normal?”, I am going to make a prediction: speed, agility and flexibility will become the new business currency, the new table stakes. Business continuity, remote work and global collaboration will simply be woven into the fabric of business.

Goldman Sachs analysts predict that the banks best equipped to whether this crisis will be those that are diversified geographically and by product, as well as highly profitable and well-capitalized. I would add this critical idea: the banks that double down on innovation and forge ahead to speed up workflow automation projects will thrive; those that cling to prior timelines, retrench or abide by existing business models will be left behind by a large margin.

In terms of a global response to the pandemic, actions from both governments and the private sector that seemed unimaginable just a few months ago are now happening fast. The same holds true for digital transformation in the financial sector.

I believe it’s time to rethink prior digital transformation playbooks. It’s time to step on the gas.

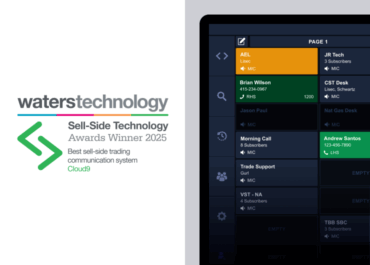

At Symphony, we are committed to supporting financial services firms during this period of disruption and transition, and we will continue to do so after the crisis has passed. During the first quarter of 2020, daily active users of our platform increased by a 40% spike, 470% higher than during the same period last year. Symphony users have sent 12 times as many messages during this time than in Q1 of 2019. We have heard from multiple customers for whom our platform has been critical to maintaining communication and operations at this unprecedented moment.

I am very proud of our team at Symphony for making a difference for our customers when they need it most. As we continue to collaborate on solutions to address COVID-19, we must remember that the only way out of a crisis is through it. And sooner rather than later, banks and financial institutions will need to plan for life on the other side. We are here to help.

If you want to see what is possible, join us at Innovate. On April 28, we will host a 100% digital Innovate Europe 2020, where executives and technology experts can discover how to streamline secure collaboration, connect information systems and automate workflow across global markets. We will showcase how to do this fast and effectively. We are excited to welcome speakers and thought leaders from the Symphony community including Bill Winters, CEO of Standard Chartered; Guillaume Lesage, COO of Amundi; and Paul Chapman, CIO of Box. We hope you will (virtually) join us! To register for Innovate Europe 2020, visit https://innovate.symphony.com/.