Investigating

ESG analytics intelligence data reporting solutions

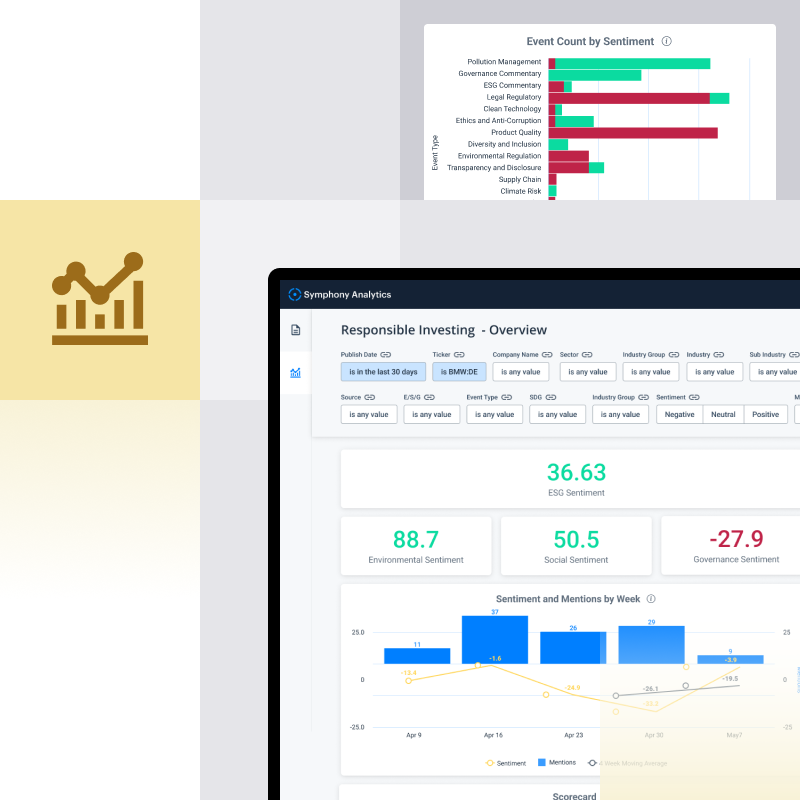

Cut through the noise with real-time analytics that alert important changes on ESG matters

As focus on Environmental, Social and Governance (ESG) issues continues to grow, so does the volume of disconnected ESG stories. Symphony Analytics' purpose-built, AI products help to decisively cut through the noise in the marketplace and monitor the information that matters

Our AI products analyze annual reports, sustainability reports, and news to track performance and surface risks via APIs, data feeds and dashboards.

From information overload to actionable intelligence

ESG Safeguard

Ready-to-use AI platform for ESG. Mitigate risks, reveal potential impact opportunities, and visualize ESG trends.

Double Materiality

Streamline compliance from ESRS reporting, simplify risk management, and enhance strategic decision-making.

ESG Data

Alpha-generating signals to assist trading strategies. Capture real-time changes in news, earnings, and more.

ESG analytics use cases

Credit Rating Agency

Symphony Analytics solutions helped to identify what ratings actions cited ESG considerations when assessing issuer credit quality.

Sell-Side Bank

Symphony Analytics maximized the investment of decades of published research by harvesting the value of the bank’s IP through an ESG lens to re-target it to a new audience.

Sustainability Investor, Greenwashing

Companies are incentivized to tell the best story possible about their ESG practices. Symphony Analytics has created a dataset that finds divergences between company statements and the news.

Sustainability Investor, Risk

Symphony Analytics' implemented monitoring and surveillance to protect portfolios against looming ESG risks that may impact performance and created investor alerts on managed portfolios.

Sustainability Investor, Materiality

Symphony Analytics' off-the-shelf ESG analytics was used for portfolio tracking to identify in real time when material ESG conversations took place in online news.

Sustainability Investor, Deception

Symphony Analytics developed a signal as a proxy for management transparency. Analyzing clarity in earnings Q&A showed outsized returns for firms with routinely low deception (high clarity).

Real-Time ESG Performance

Have greater insight on ESG issues before they’re reflected in rating changes or the markets. Symphony Analytics ESG solutions are purpose-built, transparent, and comprehensive.

Cut through the noise and flag key events and granular-level changes in company sentiment tied to ESG themes in news, SEC filings, press releases, and more—in real time.

Have specific data requirements? Our models are quickly configurable, so you can test hypotheses in days or weeks—not months or years.

Ingest or share ESG data via dashboards, alerts, plugins, or APIs. Create board-ready visualizations or feed our data into your pre-built Excel dashboards.

Use ESG news sentiment to maximize alpha in the short-term (weekly, monthly) and medium-term (quarterly) between the intervals that are covered by ESG ratings agencies.

Get started with us

We're happy to answer questions and get you acquainted with Symphony and our Messaging, Voice, Directory and Analytics platforms.

- Streamline secure collaboration

- Connect market participants and workflows

- Empower data and insights

- Enable security & compliance

- Deploy and build integrations, apps & bots

To view this form, please enable cookies in your browser settings. Click the cookie icon in the bottom right corner of your screen, select accept cookies, and refresh the page.