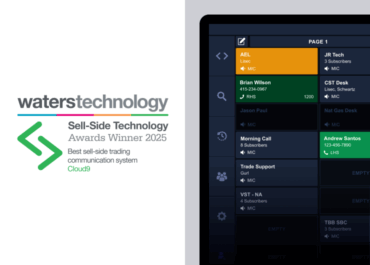

Symphony’s Cloud9 Wins ‘Best Sell-Side Trading Communication System’

Symphony’s Cloud9 has been awarded ‘Best Sell-Side Trading Communication System’ at WatersTechnology’s Sell-Side Technology Awards 2025.

In this interview we hear how Cloud9 differentiates itself with a modern, cloud-native approach to trader voice. It requires no on-premise infrastructure and functions primarily as a software application, aligning with broader cloud-based communication trends.

Cloud9’s flexible architecture empowers technology teams with robust deployment, while seamlessly supporting remote and mobile work. Michael Lynch also explains the plans for the mobile app and how it will extend voice beyond the desk to users on the go, offering 24/7 trading control.

Watch the interview to learn more.