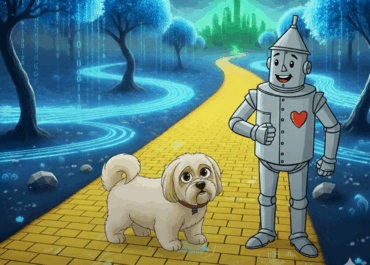

Ledgers & Tokens and Bots, Oh My!

From rare earths to magnets, autonomous agents powering drones, Crypto Bros and quantum entanglements, today’s headlines all sound complicated, spooky, and even down right scary. The reality is that a lot of change is happening in a short time, making many of us quite uncomfortable and creating great uncertainty for all.